michigan use tax act

USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal property and certain services. Section 3 of the Use Tax Act MCL 20593 provides specific language for the imposition of the tax.

The Best Ways To Spend Your Tax Refund Visual Ly Tax Refund Tax Return Income Tax

04-21 Page 1 of 1 2022 Purchasers Use Tax Return Issued under authority of Public Act 94 of 1937 as amended.

. A Person means an individual firm partnership joint venture association social club fraternal. The People of the State of Michigan enact. The Michigan Use Tax Act Sec.

Michigan first adopted a general state sales tax in 1933 and. Border-adjustment tax United States portal. To provide for the ascertainment assessment and collection thereof.

1 The use or consumption of the following services is taxed under this act in the same manner as tangible personal property is taxed under this act. A use tax is a type of tax levied in the United States by numerous state governments. However credit is given for any sales or use tax that had been legally due and paid in another state of the United States up to 6 at the time of acquisition of the property.

Michigan Department of Treasury 5087 Rev. The Michigan Use Tax Act Sec. Most states have similar rules.

Here in Michigan if you purchase tangible personal property for use in Michigan you have to either pay sales tax to the seller or pay whats called a use tax to the state. Use is defined as the exercise of any right over tangible personal property incident to ownership of that property. Tax Collector Near Me Brandon.

Telecommunications - Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone communications. As a general rule you owe this tax if you purchased merchandise and did not pay sales tax. Michigan use tax was enacted four years later effective october 29 1937.

The People of the State of Michigan enact. Typically this happens when you purchase an item for example clothing books furniture computers by telephone catalog Internet or in person from out-of-state businesses that do. The underlying concept is that if you bought the product to be used in Michigan then you should pay a use tax to Michigan.

In many states localities are able to impose local sales taxes on top of the state sales tax. McIntyre Multistate Taxation in the Digital Age Wayne State University Law School. 1 There is levied upon and there shall be collected.

Rather this amount will remain part of the state component tax. If approved the amendments will take effect in January 1 2015. As of January 1 2004 Prof.

This act may be cited as the Use Tax Act. AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees and charges to be paid to the state for the privilege of engaging in certain business activities. 1 the following are exempt from.

Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. As used in this act. As the seller you may use this form for such a transaction.

In Michigan that tax is called the use tax but might be more aptly described as a remote sales tax. To appropriate the proceeds of that tax. This act may be cited as the Use Tax Act.

Using storing or consuming vehicle ORV manufactured housing airc. Conversion to taxable use. Michigan State Legislature Act 408 Laws 2012 House Bill.

To provide incident to the enforcement thereof for the issuance of licenses to engage in such occupations. TO the extent that the telephone communication service including cost of the service passed on the customer is intrastate-both originating and terminating in Michigan. Applicability to tangible personal property or services.

Imposition of the Tax The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. A Person means an individual firm. The amendment to the Use Tax Act will not take effect unless approved by a majority vote at an election that will be held in 2014.

MCL 20591 Use tax act. A Except as provided in section 3b intrastate telecommunications services that both originate and terminate in this state including but not limited to intrastate private communications services ancillary services conference. The use tax was enacted to compliment the sales tax.

1 As used in this act. 31 MCL 20593 provides. Michigan first adopted a general state sales tax in 1933 and since that time the rate has risen to 6 percent.

Cfs Tax Software Order Form. History2004 Act 175 Eff. B Sale at retail means a transaction by which the ownership of tangible personal property is transferred for.

For example a Michigan taxpayer with 45000 of income can use the states use tax table. 2022 Quarterly Certification of Compliance by Nonparticipating Manufacturer NPM 4126. Feeling Lost In Life At 50.

Terms Used In Michigan Laws Chapter 205 Act 94 of 1937 - Use Tax Act. M Use tax means the tax levied under the use tax act 1937 PA 94 MCL 20591 to 205111. Michigan Use Tax Act.

31 MCL 20593 levies upon every person in this state a specific tax for the privilege of using storing or consuming tangible personal property in this state at a rate equal to 6 of the price of the property. Michigan Use Tax Act. History1937 Act 94 Eff.

2015 Act 177 Eff. 20591 Use tax act. Michigan General Sales and Use Tax Acts.

Aroma Indian Restaurant West Palm Beach. Mobile Al Sales Tax Rate 2019. Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a.

As used in this act. Michigan General Sales and Use Tax Acts. Michigan Laws Chapter 205 Act 94 of 1937 Use Tax Act.

Where the sales tax is. 205175 Tax on motor fuel and alternative fuel used by interstate motor carrier. USE TAX Michigans 6 use tax is imposed on a purchaser for the act of storing using or consuming tangible personal property in Michigan.

State Of Michigan Taxes H R Block

Michigan Tax Power Of Attorney Form 151 Power Of Attorney Form Power Of Attorney Thank You Letter Examples

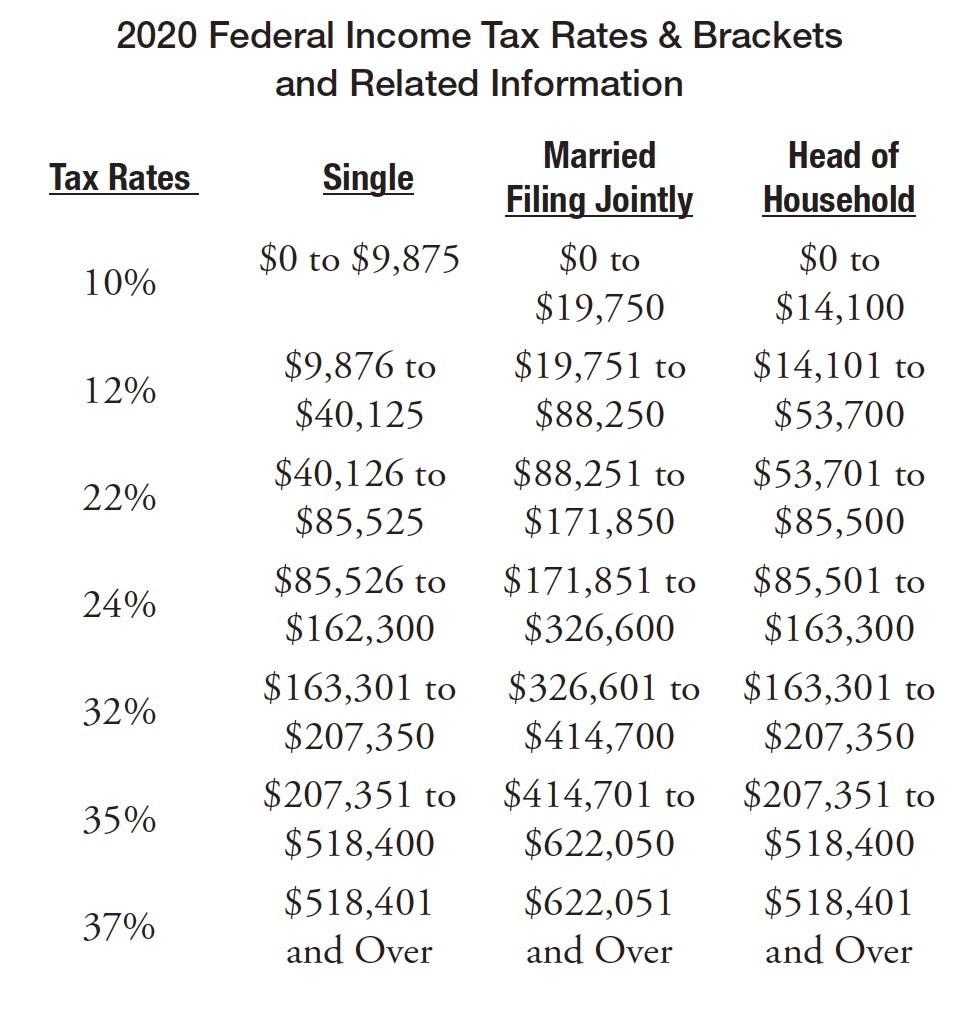

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Standard Lease Agreement Form Download Free Printable Legal Rent And Lease Tem Lease Agreement Free Printable Lease Agreement Lease Agreement Landlord

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

211 Provides Countless Resources Thruoghout Southeast Michigan School Related United Way Health Care

Michigan S Cannabis Tax Revenue Blew Up In 2021 Grown In

Michigan Family Law Support January 2019 2019 Federal Income Tax Rates Brackets Etc And 2019 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

25 Things You Learn While Living In Michigan State Of Michigan Michigan Historical Newspaper

Free Michigan Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Where S My Michigan State Tax Refund Taxact Blog

Michigan Sales Tax Handbook 2022

Pursuing A Michigan Asbestos Injury Claim Mesothelioma Lawyers Tax Attorney Tax Lawyer Injury Claims

Michigan Intestate Succession Flowchart Estate Planning Attorney Estate Planning State Of Michigan

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc